Taxpayers can choose whether to litigate tax disputes with the Internal Revenue Service (IRS) in the US Tax Court (Tax Court), federal district court or the Court of Federal Claims. Claims brought in federal district court and the Court of Federal Claims are tax refund litigation: the taxpayer must first pay the tax, file a claim for refund, and file a complaint against the United States if the claim is not allowed. Claims brought in the Tax Court are deficiency cases: the taxpayer can file a petition against the IRS Commissioner after receiving a notice of deficiency and does not need to pay the tax beforehand.

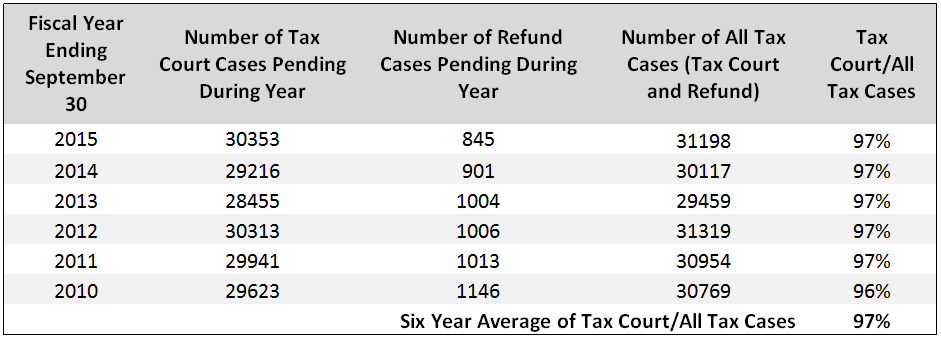

As demonstrated in the chart below, approximately 97 percent of tax claims are instituted in the Tax Court. It should be noted that, after a taxpayer files a petition in Tax Court, the taxpayer no longer has the option of bringing the claim in any other court for the year(s) at issue.

Tax Court Versus Tax Refund Litigation

Taxpayers may want to consider the following factors in deciding where to litigate their dispute:

- Timing – Tax Court petitions must be filed within 90 days of the date shown on the Notice of Deficiency, while claims in refund forums may not be filed under later. The Tax Court and Court of Federal Claims set trial dates well in advance, while scheduling in federal district court can be more unpredictable;

- Judge’s tax expertise – Tax Court judges (and, to a lesser extent, Court of Federal Claims judges) generally have more tax expertise than district court judges;

- Opposing counsel – IRS lawyers litigate in the Tax Court while US Department of Justice lawyers litigate in district court and the Court of Federal Claims;

- Ability to pay tax upfront – as mentioned above, taxpayers filing claims in district court and the Court of Federal Claims must pay taxes before litigation can be commenced, while taxpayers filing claims in Tax Court do not need to pay taxes or penalties until a decision becomes final;

- Reputation in local community – local reputation may have greater bearing in district court than in the Tax Court or the Court of Federal Claims;

- Precedent – the Court of Federal Claims follows precedent in the Federal Circuit; District Courts follow precedent in their respective Courts of Appeals; and the Tax Court follows its own precedent, and precedent that is “on all fours” with that circuit where any appeal would lie;

- Discovery – Tax Court discovery is more informal than discovery in the refund forums, does not emphasize depositions and heavily relies on stipulations; and

- Appeals – cases decided in the Tax Court or in District Court can be appealed to the federal Courts of Appeals, whereas cases decided in the Court of Federal Claims can be appealed only to the Federal Circuit.

Practice Point: Taxpayers need to carefully consider the factors mentioned above in determining whether to bring tax litigation in Tax Court, federal district court or the Court of Federal Claims. Most tax litigation occurs in Tax Court, but in certain situations it may be advantageous to file in federal district court or the Court of Federal Claims instead.