Ryan, LLC v. Internal Revenue Service[1] is the latest example of success in overcoming procedural hurdles to challenge the validity of a US Department of the Treasury (Treasury) regulation. In a recent opinion, the US District Court for the Northern District of Texas held that:

- Ryan has standing to challenge the validity of the Treasury’s final regulations[2] that require disclosure of certain transactions engaged in by businesses and their “micro-captive insurance companies” (MCICs).

- Ryan sufficiently pleaded its claim that the final regulations under challenge were “arbitrary, capricious, an abuse of discretion, or otherwise not in accordance with law” and must be set aside under the Administrative Procedure Act (APA).[3]

- The court’s opinion confirms that nontaxpayer actors may have standing to challenge Treasury regulations. The case is also another example of a plaintiff reaching the merits stage of a challenge to a Treasury regulation in the aftermath of Loper Bright v. Raimondo.[4]

Background

Ryan is an advisor to businesses seeking to establish and maintain MCICs. “Captive” insurance companies are specialized insurance companies that exist to insure the entities that own them. When the owning entities make premium payments to the captive, the premiums do not need to include commissions or other fees associated with traditional insurers, making captives an attractive option especially when coverage is unavailable or costly through traditional insurers. Certain small captive insurance companies, commonly called MCICs, qualify for favorable tax treatment. Under section 831(b), MCICs are not taxed on the first $2.2 million in premiums paid by their owner-insured. The Internal Revenue Service (IRS) has increased its scrutiny of the captive insurance industry because of concerns that these arrangements may be exploited for fraud and abuse.

The Treasury’s new regulations

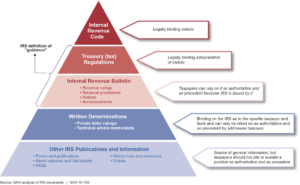

Section 6707A requires the disclosure of certain “reportable transactions,” defined as transactions that, in the IRS’s determination, have a “potential for tax avoidance or evasion.” A “listed transaction” is a type of reportable transaction in which the taxpayer is presumed to have engaged in the transaction for the purpose of tax avoidance or evasion.[5] A “transaction of interest” is a reportable transaction designated by the IRS as having a potential for abuse but is not presumed abusive.[6] These designations create heavy reporting requirements by taxpayers and their advisors (e.g., Ryan).

Under the Treasury’s new regulations, a micro-captive insurance transaction is defined based on a loss ratio factor and a financing factor. The loss ratio factor is the ratio of the captive insurance company’s cumulative insured losses to the cumulative premiums earned over a specified period, typically the most recent 10 taxable years (or all years if less than 10). The financing factor refers to whether the captive insurance company participated in certain related-party financing arrangements within the most recent five taxable years, such as making loans or other transfers of funds to insureds, owners, or related parties. A transaction is classified as a “listed transaction” if the MCIC’s loss ratio is [...]

Continue Reading

read more

Subscribe

Subscribe