Check out our summary of significant Internal Revenue Service (IRS) guidance and relevant tax matters for the week of April 10, 2023 – April 14, 2023.

April 10, 2023: The IRS released Internal Revenue Bulletin 2023-15, which highlights the following:

- Revenue Procedure 2023-20: This revenue procedure modifies the effective date of additions to the taxable substances or chemicals list under Section 4672(a). Specifically, this revenue procedure changes the date on which substances are added to the list for purposes of refund claims under Section 4662(e).

- Notice 2023-27: This notice announces that the US Department of the Treasury and the IRS intend to issue guidance related to the tax treatment of certain non-fungible tokens (NFTs). The guidance requests comments on the treatment of NFTs as collectibles and describes how the IRS intends to determine whether an NFT is a collectible until further guidance is issued.

- Notice 2023-28: This notice extends temporary relief regarding deposits of the excise tax imposed on certain chemicals under Section 4661 and the excise tax imposed on certain imported chemical substances under Section 4671 (collectively, Superfund chemical taxes). The extended relief is available in connection with deposits of the Superfund chemical taxes for semimonthly periods in the second, third and fourth calendar quarters of 2023.

- REG-120653-22: These proposed regulations implement the advanced manufacturing investment credit, a new current-year business tax credit under Section 48D to incentivize the manufacture of semiconductors and semiconductor manufacturing equipment within the United States. The regulations address the credit’s eligibility requirements, an election that eligible taxpayers may make to be treated as making a payment of tax (including an overpayment of tax) or for an eligible partnership or S corporation to receive an elective payment instead of claiming a credit, and a special 10-year credit recapture rule that applies if there is a significant transaction involving the material expansion of semiconductor manufacturing capacity in a foreign country of concern.

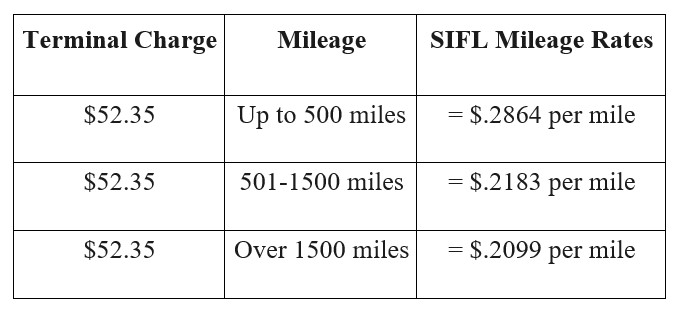

- Revenue Ruling 2023-7: This revenue ruling provides the fringe benefits aircraft valuation formula. For purposes of Section 1.61-21(g) of the regulations, relating to the rule for valuing non-commercial flights on employer-provided aircrafts, the Standard Industry Fare Level (SIFL) cents-per-mile rates and terminal charge in effect for the first half of 2023 are as follows:

April 10, 2023: The IRS released Tax Tip 2023-47, providing guidance on when to file an amended income tax return.

April 10, 2023: The IRS and the Treasury issued Notice 2023-30, providing safe harbor deed language for extinguishment and boundary line adjustment clauses as required by the SECURE 2.0 Act of 2022. Section 605(d)(2) provides donors with the opportunity to amend certain conservation easement deeds to substitute the [...]

Continue Reading

read more

Subscribe

Subscribe