Check out our summary of significant Internal Revenue Service (IRS) guidance and relevant tax matters for the week of April 10, 2023 – April 14, 2023.

April 10, 2023: The IRS released Internal Revenue Bulletin 2023-15, which highlights the following:

- Revenue Procedure 2023-20: This revenue procedure modifies the effective date of additions to the taxable substances or chemicals list under Section 4672(a). Specifically, this revenue procedure changes the date on which substances are added to the list for purposes of refund claims under Section 4662(e).

- Notice 2023-27: This notice announces that the US Department of the Treasury and the IRS intend to issue guidance related to the tax treatment of certain non-fungible tokens (NFTs). The guidance requests comments on the treatment of NFTs as collectibles and describes how the IRS intends to determine whether an NFT is a collectible until further guidance is issued.

- Notice 2023-28: This notice extends temporary relief regarding deposits of the excise tax imposed on certain chemicals under Section 4661 and the excise tax imposed on certain imported chemical substances under Section 4671 (collectively, Superfund chemical taxes). The extended relief is available in connection with deposits of the Superfund chemical taxes for semimonthly periods in the second, third and fourth calendar quarters of 2023.

- REG-120653-22: These proposed regulations implement the advanced manufacturing investment credit, a new current-year business tax credit under Section 48D to incentivize the manufacture of semiconductors and semiconductor manufacturing equipment within the United States. The regulations address the credit’s eligibility requirements, an election that eligible taxpayers may make to be treated as making a payment of tax (including an overpayment of tax) or for an eligible partnership or S corporation to receive an elective payment instead of claiming a credit, and a special 10-year credit recapture rule that applies if there is a significant transaction involving the material expansion of semiconductor manufacturing capacity in a foreign country of concern.

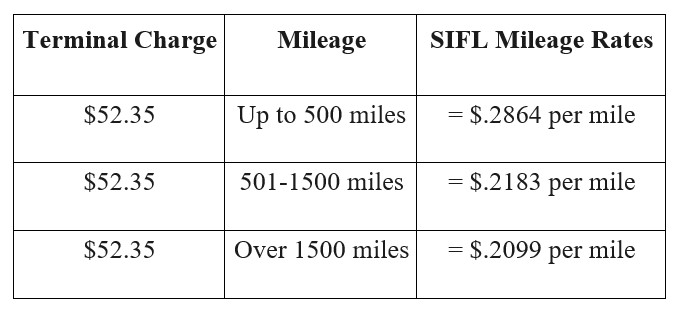

- Revenue Ruling 2023-7: This revenue ruling provides the fringe benefits aircraft valuation formula. For purposes of Section 1.61-21(g) of the regulations, relating to the rule for valuing non-commercial flights on employer-provided aircrafts, the Standard Industry Fare Level (SIFL) cents-per-mile rates and terminal charge in effect for the first half of 2023 are as follows:

April 10, 2023: The IRS released Tax Tip 2023-47, providing guidance on when to file an amended income tax return.

April 10, 2023: The IRS and the Treasury issued Notice 2023-30, providing safe harbor deed language for extinguishment and boundary line adjustment clauses as required by the SECURE 2.0 Act of 2022. Section 605(d)(2) provides donors with the opportunity to amend certain conservation easement deeds to substitute the safe harbor language for the corresponding language in the original deed. Taxpayers will have until July 24, 2023, to record their safe harbor deed amendments.

April 10, 2023: The IRS announced proposed regulations identifying certain micro-captive transactions as “listed transactions” and certain other micro-captive transactions as “transactions of interest” in Announcement 2023-11.

April 10, 2023: The IRS announced that Tennessee storm victims now have until July 31, 2023, to file various federal individual and business tax returns and make tax payments as a result of tornados, severe storms and straight-line winds that occurred starting on March 31, 2023. Relief is available to anyone in an area designated by the Federal Emergency Management Agency (FEMA) as qualifying for individual or public assistance. The current list of eligible localities is available here.

April 11, 2023: The IRS announced that it wants to debunk common myths about filing taxes, finding refund information and adjusting withholding. For example, one untrue myth is that taxpayers don’t need to report income if they didn’t receive a Form 1099-K. The filing deadline for income tax returns is April 18, 2023.

April 11, 2023: The IRS released Tax Tip 2023-48, reminding taxpayers that common errors on a tax return can lead to longer processing times.

April 11, 2023: The IRS announced that taxpayers who filed their federal income taxes early in this year’s filing season and reported certain state 2022 tax refunds as taxable income should consider filing an amended return.

April 12, 2023: The IRS reminded taxpayers of the upcoming estimated tax payment deadline. April 18 (Tax Day) is also the deadline for first quarter estimated tax payments for tax year 2023.

April 12, 2023: The IRS released Tax Tip 2023-49, informing taxpayers of how to claim clean vehicle tax credits. Beginning January 1, 2023, eligible vehicles may qualify for a tax credit of up to $7,500. The amount of the credit depends on when the eligible new clean vehicle is placed in service and whether the vehicle meets certain requirements for a full or partial credit.

April 12, 2023: The IRS released Revenue Ruling 2023-8, which obsoletes Revenue Ruling 58-74. Revenue Ruling 58-74 allowed taxpayers to file a claim for refund or amended return to deduct research or experimental expenditures that for prior taxable years, the taxpayer had failed to deduct and for which the expense method under former Section 174(a) was applicable.

April 12, 2023: The IRS announced that nearly 1.5 million people across the nation have unclaimed refunds for tax year 2019 and face a July 17 deadline to submit their tax returns.

April 13, 2023: The IRS released Tax Tip 2023-50, reminding taxpayers that they have the right to pay no more than the correct amount of tax due. This is one of the 10 basic rights known as the Taxpayer Bill of Rights.

April 13, 2023: The IRS reminded low- to moderate-income taxpayers to consider IRS FreeFile for preparing their own federal tax return to potentially receive tax credits or refunds.

April 14, 2023: The IRS issued FAQs in Fact Sheet FS-2023-11, providing guidance for victims who have received state compensation payments for forced, involuntary or coerced sterilization.

April 14, 2023: The IRS released its annual Data Book for fiscal year 2022, describing the agency’s activities, including revenue and tax returns processed. The 2022 Data Book reports examination coverage rates by type and size of return for examinations in process or closed as of September 30, 2022. In an announcement, the IRS explained that the Inflation Reduction Act of 2022 provides resources to expand enforcement areas where current audit rates have been too low to address systematic noncompliance while encouraging some taxpayers to take greater risks given such low audit rates.

April 14, 2023: The IRS released its weekly list of written determinations (e.g., Private Letter Rulings, Technical Advice Memorandums and Chief Counsel Advice).

Upcoming Events: Registration for the 2023 IRS Nationwide Tax Forums is now open, and the events are returning to an in-person format for the first time since 2019. The IRS Nationwide Tax Forums are designed specifically for tax professionals (e.g., enrolled agents, certified public accountants, certified financial planners and Annual Filing Season Program participants) as well as uncredentialed tax professionals. The dates and locations are as follows:

- July 11-13: New Orleans, LA

- July 25-27: Atlanta, GA

- August 8-10: National Harbor, MD (Washington, DC area)

- August 22-24: San Diego, CA

- August 29-31: Orlando, FL